On January 19, 2017, CCM and Tranalysis offered a free webinar for the market trend of sugar and sweeteners in China, 2016. CCM now gives you the chance to read the script once again.

CCM has also uploaded the recorded video of the webinar on YouTube.

Subscribers of our YouTube channel China Sugar and Sweeteners webinar will be informed per email, whenever a new video about China's sugar and sweetener market has been uploaded.

Many

factors are affecting the sugar and sweetener market in China recently.

Environmental health policies are limiting the production of sweeteners in

China. Also, a Pollutant Discharge Licensing System is being implemented, which

will without any doubt influence the sweeteners industry in China ones more.

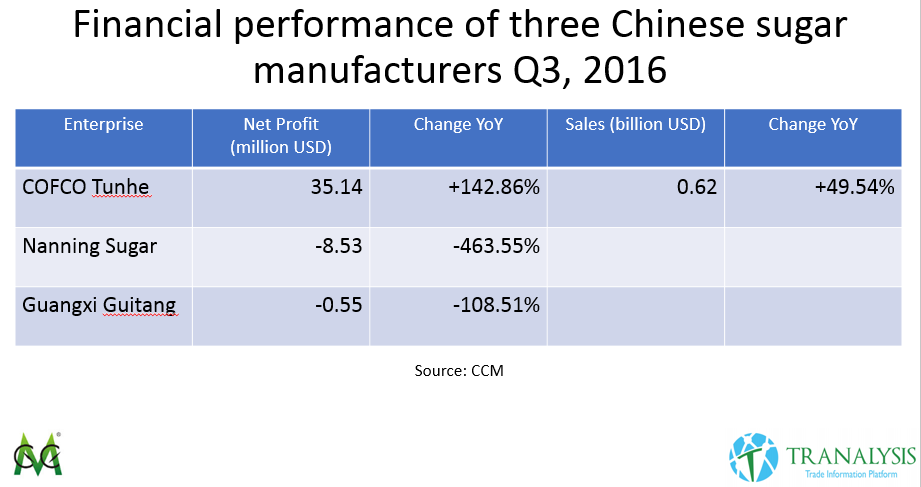

The financial performance of Chinese sugar manufacturers varied greatly in Q3,

resulting of increasing production costs, rising sugar price, and decreasing

sales volume. In 2015 and 16 the planting area of sugarcane in China decreased,

leading to a shortage of sugar, which is the main reason for the current high

prices.

The agenda

First,

you will see insights in the overall market situation of sugar and sweeteners

in China. Furthermore, some information about the current pollution

measurements and production reductions are explained. Then you see information

about some enterprises performance in Q3 2016. Finally, the export trend of two

important sweeteners 2016 will be revealed.

Market trends

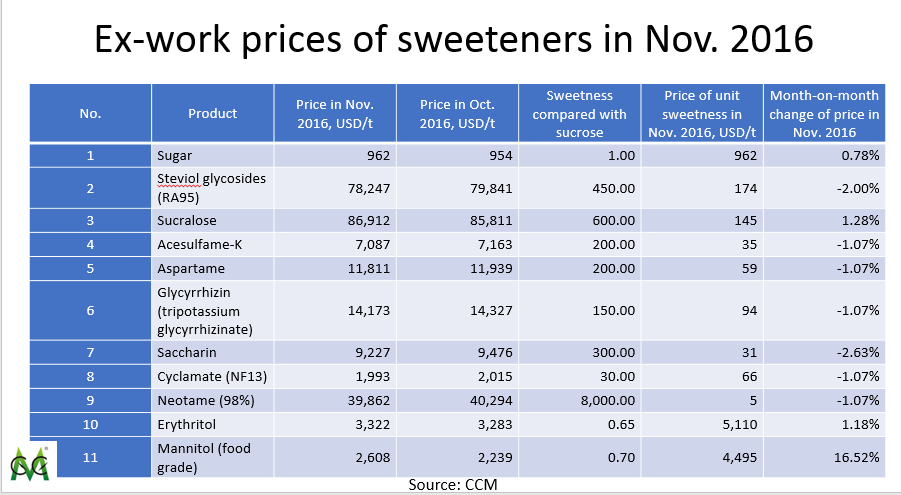

At the beginning,

have a look at the Ex-works price of some sweeteners in China, November 2016.

It shows, that the overall development for most of the products didn’t change

very much compared to October. Only Mannitol experienced an outstanding

increase of 16.52%.

During

the last year, the planting area of sugarcane did decrease. This causes a

higher purchase cost for the sugar producers, due to shorter supply.

Additionally some heavy rain during that time also reduced the quality of

sugarcane, increasing the cost of sugar manufacturing ones more.

The

increasing costs even exceeded the increasing prices of sugar, which actually

led to losses for many manufacturers, according to CCM’s analysis. Downstream

users searched for substitutes for the more expensive sugar in China, also led

to a declined sales volume.

CCM

furthermore predicts, that the sugar price will continue rising in China. The

reasons are a depreciating RMB, limited growth of the sugar output in 2016 and

17 as well as expected decreased imports. However, the price rise will be

limited, due to the launch of the national sugar reserves, the new production

of sugar in the coming period and more substitutes for sugar.

It

is expected, that 56.65 million tonnes of sugarcane and 5.7-5.9 million tonnes

of white sugar will be produced in China in the season 2016/17.

The

new import tariff of sugar is deciding, how the sugar price will develop. For

an increased tariff with expected growth, the sugar price will stay high in

China, due to tight sugar supply. But new supply and substitutes will keep the

prices limited. For an increased tariff but slow growth, fluctuations in price

are possible with higher price than the world market. For the unlikely case the

tariffs are not raised, sugar price will fall.

The

inventory in China is historically low with an amount of 203,700 tonnes in October

2016.

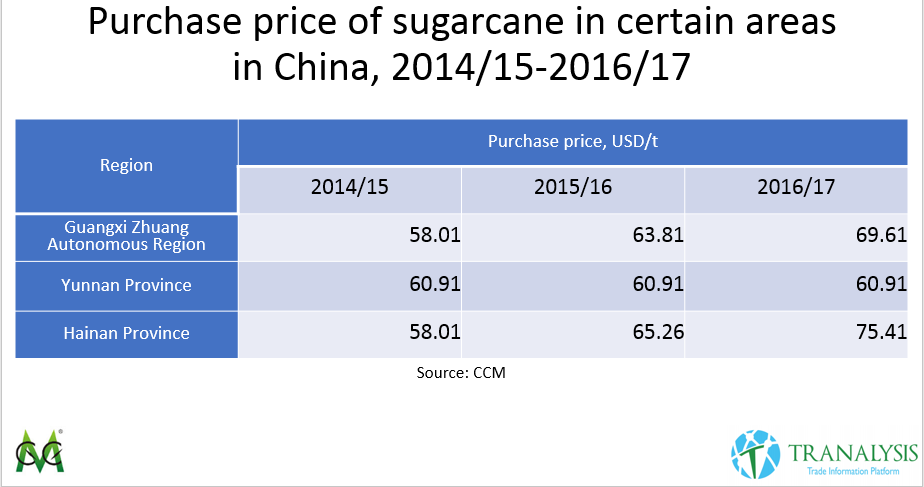

The

purchase price of sugar in three different regions in China show the

development of increasing prices in China.

Globally

analysed, the sugar shortage is going to reach 6.2 million tonnes 2016/17, what

would represent a record high. This is mainly due to Brazil’s peak extraction

period at the moment.

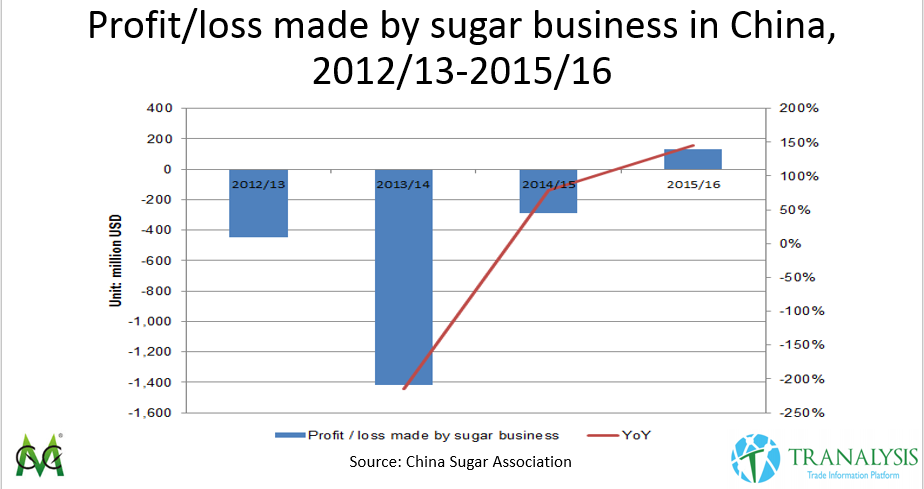

As

a result, after loses in the last three years, sugar makers in China are going

to make profits in this season. CCM believes, that this trend will go on for

the season 2016/2017.

Market dynamics of

sucralose

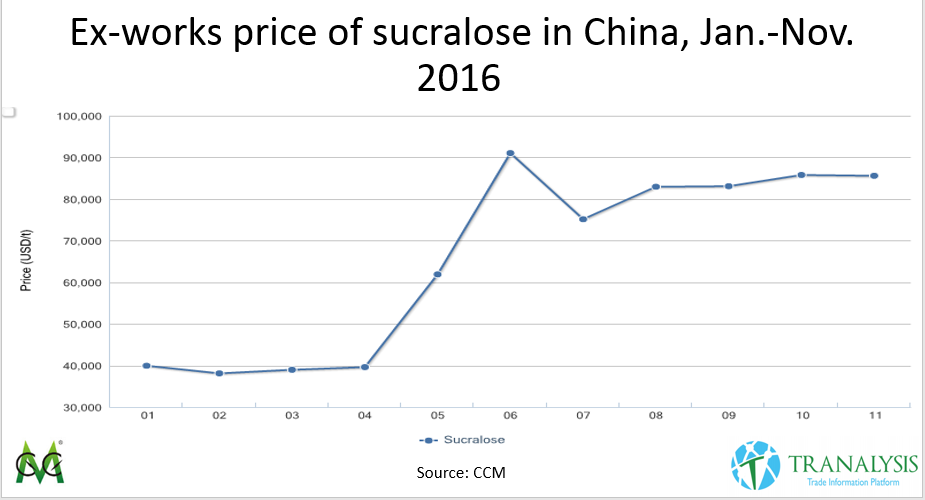

Sucralose

experienced an increase of over 100% in 2016, mostly caused by short supply

because of environmental protection and the resulting price rise. It is

expected, that manufacturers grow their production to balance the short supply,

which will shrink prices again.

The

case of JK Sucralose’s production suspension demonstrates the short supply

situation of sucralose in China 2016. It even led to a lack in inventory for

many companies.

The

company had to reduce production because of the order from the Environmental

Protection Bureau of Jiangsu Province, stating, that the wastewater treatment

of the facility didn’t meet standards. JK Sucralose is the largest sucralose

manufacturer in China and the second biggest in the world, with capacity of

2,000 t/a, so the suspension of his production had a huge impact on the supply

situation in China. The reduction affected about 40% of production, which makes

the producers still larger than competitor’s production.

According

to CCM, the ex-works price of sucralose was USD86,912/t in November 2016.

That’s just a 1.28% rise MoM, but more than 100% compared to January 2016.

The

fastest growth took place in June with 56.25% increase alone.

Since

sucralose is made of sugar, the increasing sugar price is affecting the

sucralose price immensely. According to sucralose manufacturers, a further

price rise of sucralose is very likely, if the sugar price keeps rising as

well.

Sucralose

manufacturers are going to expend their production of their product in the

future, to balance out the short supply and make more profits out of this more

profitable product.

After

looking at some market trends, let’s have a look at the environmental

protection measurements, that are affecting the price of sweeteners decisively

in China.

Stricter environmental

policies

Since Jan. 2015 when the new Environmental

Protection Law of the People's Republic of China was implemented officially, the

government had increased focus on environmental pollution.

Feb. 2015: the Water Pollution Prevention and Control Action Plan was issued

June 2016: the Ministry

of Environmental Protection of the People's Republic of China solicited public

opinions on the Water Pollution Prevention and

Control Law of the People's Republic of China (Draft for Revision)

Nov. 2016: the State

Council issued the Proposal to Control Pollutant

Discharge Licensing

Jan. 2018: the Environmental Protection Tax Law will come to effect

All this forced sweetener manufacturers to

limit or suspend production. In July 2016, JK Sucralose Inc. was ordered to

suspend production for its substandard discharge of wastewater. Though it

resumed production at the end of September, the output was small. Notably, many

enterprises were not operating at full capacity, according to CCM's research.

Environmental

pressure takes place in many sweetener industries in China. CCM has surveyed

some manufacturers to get insights into the effects on their industries.

As

mentioned before, sucralose suffered a production reduction mainly based on the

order to JK Sucralose. But also other producers like Anhui Jinhe are affected

by stricter laws and have to make big investments in waste discharge solutions.

The treatment of wastewater from the production of sucralose needs large

quantity of funding and specific equipment in general.

Also,

besides the big investments most of the producers cannot use their full

production capacity, due to environmental issues. Currently, Shandong Kanbo

Biochemical is the biggest supplier of sucralose with a capacity of 4,000t/a.

Natural

Sweeteners like Steviosides, Mogrosides, and Glycyrrhizin are also affected by

production restrictions.

The

high industry sweeteners in China, like Acesulfame-K and aspartame are

suffering low profits currently. Also affected by the environmental policy,

especially small manufactures have even cut their whole production, not able to

afford the equipment for the required wastewater treatment.

The environmental pollution effort also includes the

enlargement of so-called pollutant discharge licenses, which will likely have a

negative effect on Chinese sweetener producers. The measurements come into

action because the quality of air and water in many regions have not achieved

the standard value for a long time.

The main idea of controlling the pollutant discharge are

discharged licenses, that requires mainly manufacturers with pollutant emission

to be licensed until 2020. The goal of the licenses is to reduce and cut

pollution, which will help to achieve the standard value of quality for many

regions again.

The new system is supposed to clear out past vagueness

and will be supervised more strictly. CCM has listed the key measures from the

proposal of November 21, 2016.

First of all, the system changes from an

administrative area pollutant discharge system to a certain organisation

affecting one. The applications for licensing should be done before the actual

project construction, which serves as a reference for the planned regular

environmental checks. It also allows authorities to monitor pollution in

advance.

The management of the licensing management requires a

catalogue, created by the environmental protection departments, about the

pollutant discharge. This will be accordingly changed to the different type of

industries and their impact on the environment. The organisations can then

apply for the license by stating their pollution variety, amounts, and

concentration.

The governmental departments are requested to do

inspections more frequently, according to the pollution emission of companies,

and get the rights to punish blunder with production limitation, suspension,

and shutdown. On the other side, the licensing system encourages organisations

to give themselves stricter pollution limits, which can be regarded by

preferential electricity prices and governmental preference.

This newly implemented license will be the only

permission for organisations to emit any pollution. Every other method will be

illegal. The licenses will be granted for three years in the first place and

five more years after every renewal.

According to CCM, the sweetener industry may be

impacted, too, looking at high pollution manufacturers especially in the

high-intensity sweetener business. These include for example the production of

sucralose.

Looking at the small enterprises, who cannot afford

the treatment equipment necessary for the license and bigger manufacturers with

their production likely being reduced, the whole output of the sweetener

industry in China may decrease the next years notably.

Financial performance

The

financial performance of China’s sugar manufacturers had large varieties in Q3,

2016. It was mainly resulting of increasing production costs, rising sugar

prices, and a decreasing sales volume.

The

big winner was COFCO Tunhe with a Sales increase of 49.54% YoY and a net profit

increase of remarkably 142.86% YoY.

The

reasons for the big success, according to the company, was the rebounded sugar

price.

Other

companies like Nanning Sugar and Guangxi Guitang on the other hand did write

down losses in 463.55% and 108.51% YoY respectively. They are explained by high

costs and a decreased gross profit margin.

Supply and demand for sugar

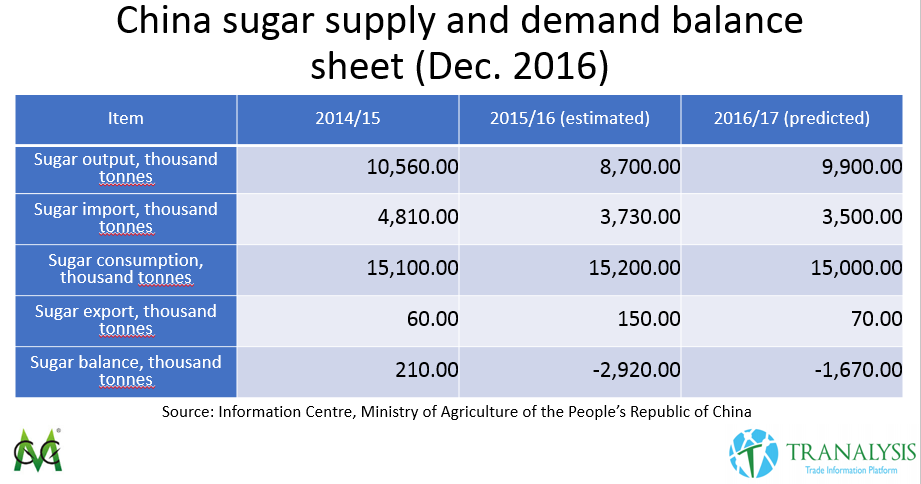

According

to CCM the number of sugar plants in operation as well as the daily extraction

capacity are more in this season compared to the season last year. Therefore,

the sugar output is likely to grow again, due to increasing sugarcane supply

and an enlarged planting area. The Ministry of Agriculture in China stated a

rose of sugar output of 1.20 million tonnes up to 9.90 million tonnes in

December already.

Anyway,

the worldwide sugar shortage of estimated 2.63 million tonnes 2016/17 also has

its impact on China, leading to decreased imports to China of 3.5 million

tonnes. Looking at the consumption of 15 million tonnes and exports of 70,000

tonnes, China’s sugar shortage may reach about 1.67 million tonnes this season.

Trade analysis

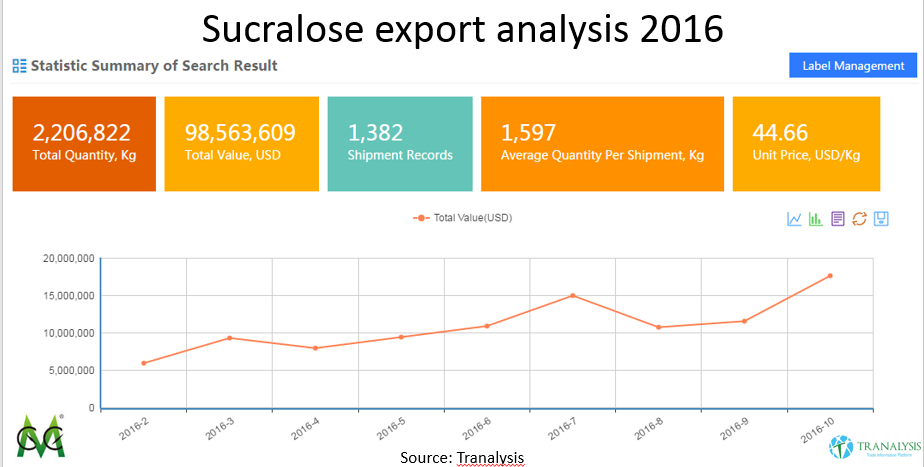

Sucralose

had a total export quantity of 2,206,822 kg in the year 2016 till October. The

average unit price has been 44.66 USD per kg, which resulted in the total value

of exports with over 98 million USD. The trend of total value furthermore went

up during the year, with a small drop in August.

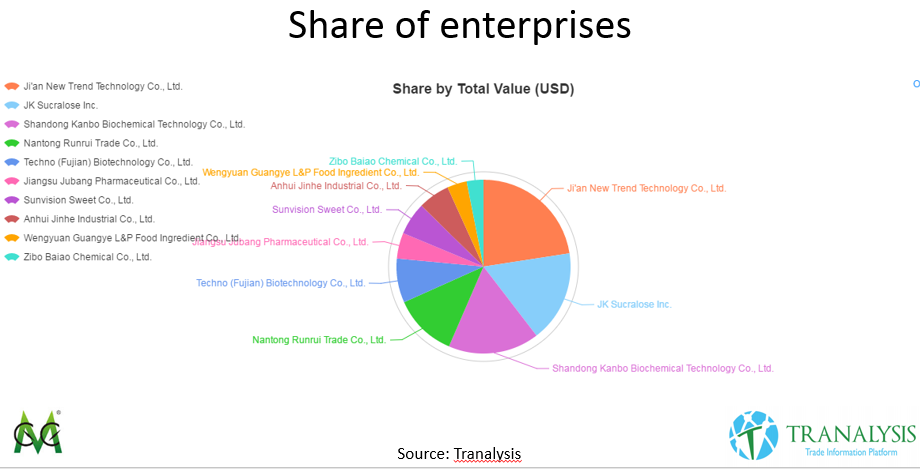

The

top exporting enterprises of sucralose have been Ji an New Trend Technology, JK

Sucralose, and Shandong Kanbo Biochemical Technology. While Ji an New Trend was

the first place with some space to the second one regarding export value, JK

Sucralose and Shandong Kanbo had a very even export value.

Together

the three leading enterprises were responsible for more than half of the whole

export in China from Jan to Oct 2016.

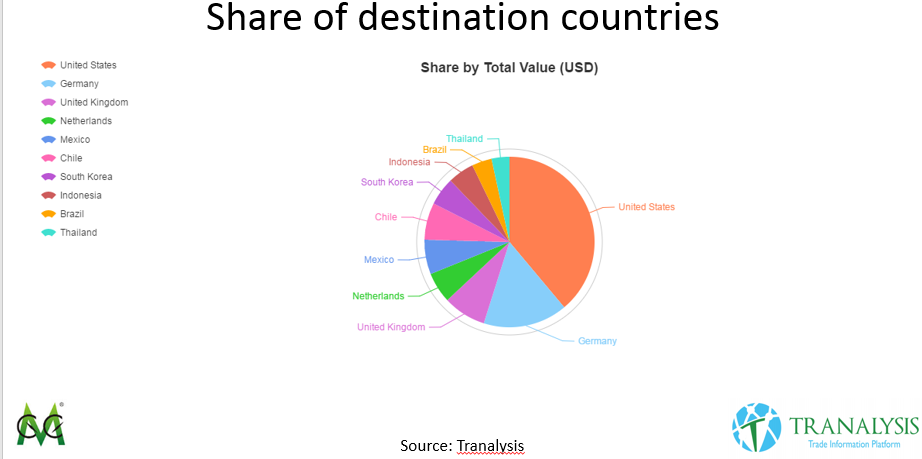

The

main destination country of sucralose exports was the USA with a total value of

almost 29 million USD. Germany and the UK are on the next places, with

significantly lower imports

Looking

at the share of the countries, it is obvious that the USA and Germany together

important more than half of sucralose from China. The share of the other

countries is much more even though.

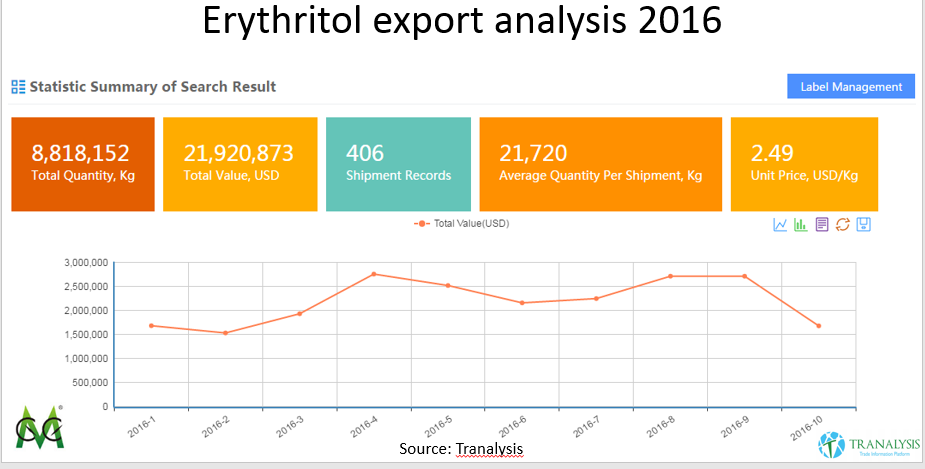

At

second, we take a look at Erythritol. Erythritol export value had a slight fluctuation

throughout the year, with a large drop in October 2016. The total quantity was

8,818,152 kg with an average unit price of 2.49 USD/kg. The total value have

been 21,920,873 USD

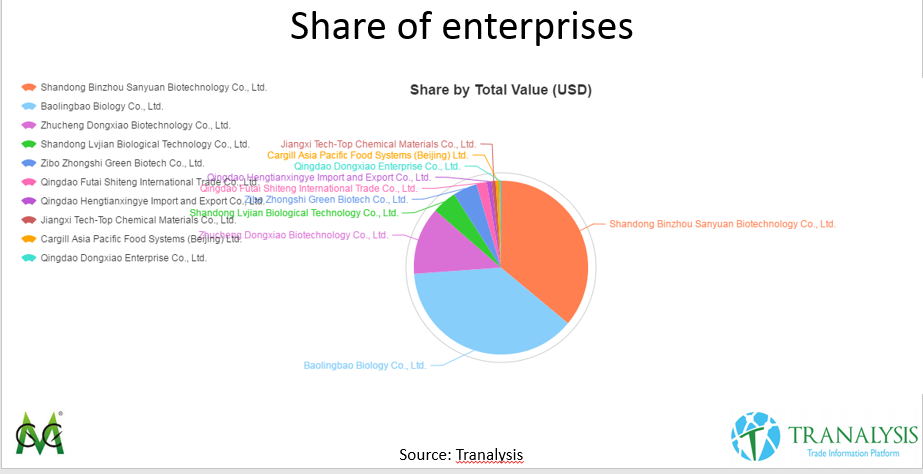

The

three main exporting enterprises in China for Erythritol have been Sanyuan

Biology, Baolingbao Biology, and Zhucheng Dongxiao. However, Sanyuan and

Baolingbao have exported a much higher value than the third place Zhucheng.

The

share of the main two enterprises almost hitting the 75% of total exports,

while the other companies did not show any greater appearance.

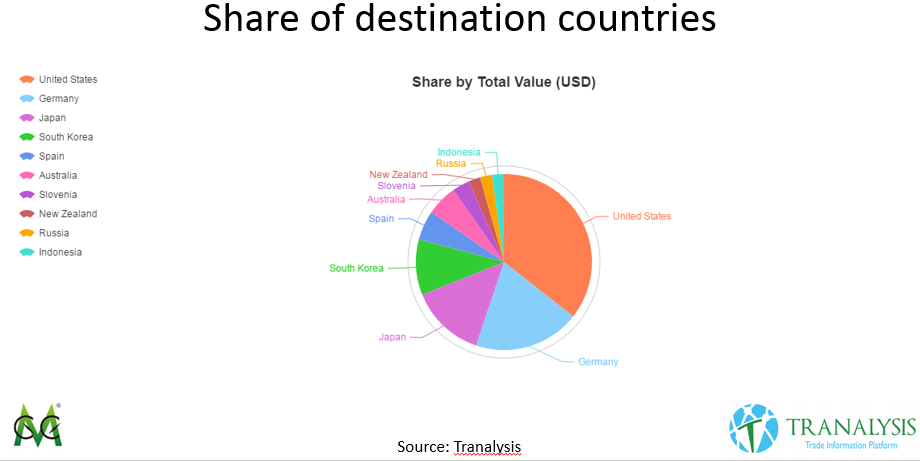

The

biggest importing countries of Erythritol from China in 2016 till October have

been countries, we already seen at the top of the other sweeteners, namely the

USA, Germany and Japan. The import value of this sweetener is more balanced

between several companies, while the USA is still top importer with quite a bit

range to Germany.

Again,

the three main importers are responsible for about two-third of the total

export value.

For

a deeper trade analysis of any sweetener product in China, feel free to contact

Tranalysis for a consult and customized report.